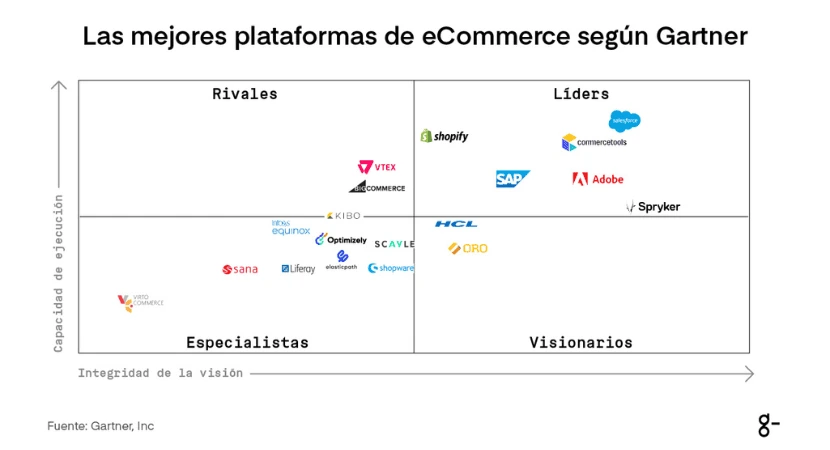

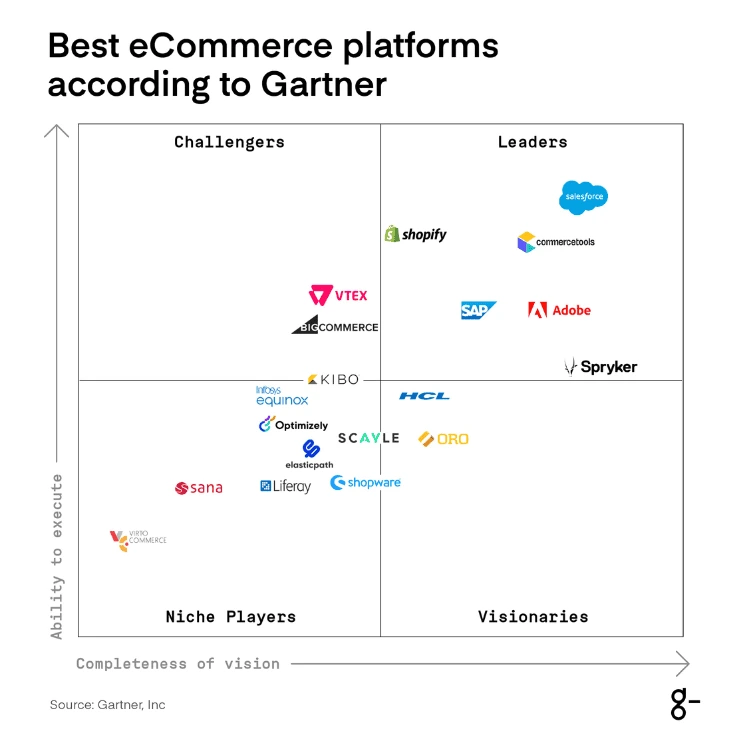

The results for this list were obtained from Gartner's Magic Quadrant for Digital Commerce, published in November 2024. This tool categorizes technology providers into four quadrants based on their ability to execute and the completeness of their vision:

Leaders: Excel in both execution and vision. These are well-established, innovative, and reliable companies in the market.

Challengers: Show strong execution capabilities but often have a less innovative or narrower vision.

Visionaries: Possess an innovative market vision but have yet to achieve high execution capabilities.

Niche Players: Focus on a specific market niche with limited execution capabilities but offer value in their specialized area.

Gartner's Magic Quadrant is a highly popular technology report because it allows businesses to compare providers quickly and visually, assessing their strengths and weaknesses to facilitate informed technology investment decisions.

What is an eCommerce platform?

An eCommerce platform is software or a system that enables the creation, management, and operation of an online store to sell products or services. These platforms provide the necessary tools to build a website, manage inventory, process payments, handle shipping, and offer customer support, among other key functions.

eCommerce platforms are essential for any business aiming to sell products or services online, as they simplify sales operations and enhance the user experience.

Summary of Gartner's Evaluation

This Magic Quadrant assesses the viability of 18 digital commerce providers to help application leaders make informed decisions.

It is divided into four categories: Leaders, Challengers, Visionaries, and Niche Players.

Gartner monitored over 160 providers in this market, 19 of which met the inclusion criteria for this Magic Quadrant. One provider was excluded, but this does not imply that it lacks viability or that its products are not valuable.

This Magic Quadrant is based on primary and secondary research conducted by Gartner. This research included, but was not limited to:

Gartner Peer Insights reviews for "Digital Commerce" published between July 30, 2023, and July 30, 2024.

Forecast: Enterprise Application Software, Worldwide, 2021–2027, 2Q23 Update.

Briefings and recorded demonstrations where providers shared product capability information with Gartner.

Feedback on providers and their products collected during thousands of conversations and other interactions with Gartner clients throughout 2023 and the first seven months of 2024.

Publicly available information sources.

Evaluation Criteria for eCommerce Platforms

Gartner used specific criteria for inclusion, such as platform product descriptions, functionality, production, new customers, and recognized annual revenue. The criteria providers needed to meet for inclusion in the evaluation were:

Ability to execute, this included product types, business models and revenue, sales strategies, geographic focus, and the type of customer experience (CX) they aim to deliver.

Completeness of Vision, this considered understanding of market needs, product (offering) strategy, and innovation.

The study revealed the following strengths and weaknesses of the providers:

Leaders

1. Salesforce

Salesforce offers three multitenant SaaS products: B2C Commerce for large-scale consumer sales, B2B Commerce for business-to-business sales, and D2C Commerce for smaller-scale sales.

Serves medium and large organizations (B2B and D2C) and large enterprises (B2C) across various geographies and industries.

Particularly suitable for existing customers due to its native integration with other Salesforce offerings.

Strengths: Industry and geographic coverage, broad functionality, and headless enablement for B2C.

Weaknesses: Its core architecture is monolithic, customers may need additional licenses, and its B2C Commerce Cloud platform is in transition while developing native shared services.

2. Shopify

Shopify is a multitenant SaaS product and also offers its cart and payment process as a standalone headless solution.

Serves clients across many industries, primarily retail. Shopify Plus is often used by medium-sized organizations.

Ideal for businesses seeking a fast time-to-market due to its easy setup, extensive portfolio, robust APIs, and flexible data model.

Strengths: Innovation, market dominance, and support for multiple channels, including digital, physical stores, social media, marketplaces, and B2B/B2C models.

Weaknesses: Limited breadth of use cases, enterprise pricing includes a fixed subscription, and its multistorefront functionality lacks localization for products, pricing, promotions, and content.

3. commercetools

commercetools is a multitenant SaaS product deployed on Google Cloud Platform, AWS, or Microsoft Azure. Its core offerings include B2B, B2C, frontend solutions, and additional functional modules.

Serves industries such as retail, manufacturing, wholesale, life sciences, and healthcare.

Best suited for large, digitally mature businesses due to its modular and scalable offerings.

Strengths: Composable, extensible, and scalable architecture; tailored solutions for complex, high-volume needs; highest customer growth rate.

Weaknesses: Implementation complexity, reliance on third-party applications for advanced AI features, and limited global presence affecting market reach and recognition.

4. Adobe Commerce

Adobe Commerce can be deployed on-premises or in public clouds (with or without Adobe-managed services) and is globally available on Amazon Web Services (AWS) or Microsoft Azure.

Serves a variety of industries, with a strong focus on manufacturing and retail, followed by telecommunications, technology, and life sciences.

Particularly suitable for current Adobe customers due to its native integration with the complete Adobe suite.

Strengths: Delivers a seamless, personalized customer experience across its product portfolio; offers core commerce functionality (B2C); and its new FEaaS (Frontend-as-a-Service) is natively integrated into DXP platforms.

Weaknesses: Upgrades can be challenging for clients; its cloud offerings are not true SaaS and require a full-stack development team to manage.

5. SAP

SAP Commerce Cloud includes a single-tenant PaaS hybrid platform, hosted on Microsoft Azure, and multitenant SaaS components, such as search and merchandising, order management, payments, and product recommendations.

Serves multiple sectors, focusing on retail, manufacturing, consumer products, professional services, and large wholesale organizations.

Best suited for global organizations with complex catalogs and business models, thanks to its out-of-the-box (OOTB) capabilities for B2B and B2C use cases.

Strengths: Supports most industry sectors, offers the largest number of industry-specific accelerators, and provides comprehensive B2B functionality for global organizations operating in multiple geographies.

Weaknesses: Lags in frontend development tools, has a rigid pricing structure compared to competitors, and its architecture remains predominantly monolithic.

6. Spryker

Spryker Cloud Commerce OS is deployed as PaaS, primarily on AWS, but also supports Microsoft Azure and Google Cloud Platform. It offers three independent modules at an additional cost: a frontend development tool (Composable Storefront), a no-code integration hub (App Composition Platform), and a marketplace operation application (Spryker Enterprise Marketplace).

Most of its clients operate in manufacturing, retail, and distribution.

Ideal for customers requiring a combination of B2B, B2C, B2B2X, and marketplace business models due to its modular and flexible approach and broad capabilities.

Strengths: Provides a headless, modular architecture; supports complex business models; and recently introduced an auction tool for organizations looking to integrate auctions into their commerce operations.

Weaknesses: Limited support, requiring new clients to verify availability; low market recognition; and a complex implementation architecture for those seeking a pre-packaged solution.

Retadores

7. VTEX

VTEX is a multitenant SaaS solution deployed on AWS, offering 22 independent modules sold separately or as a suite across five areas: digital commerce, distributed order management, marketplace operations, channel management, and experience management.

Primarily serves retail and manufacturing sectors. Initially focused on small businesses in Latin America, VTEX now boasts large international clients.

Suitable for organizations seeking B2C and B2B use cases on a unified platform due to its modular architecture and capabilities.

Strengths: Features a modular and composable API-based architecture, including a headless CMS; offers innovation plans for B2C and B2B; and enhances key functionality for store integration.

Weaknesses: Business user experience may be complex, has limited native customization capabilities, and lacks extensive global experience or expertise with large enterprises.

8. BigCommerce

BigCommerce is a multitenant SaaS platform hosted on Google Cloud Platform.

Most clients are in retail, though the platform is now targeting mid-market B2B customers.

Ideal for mid-market businesses seeking flexibility due to the platform's composability and modern architecture.

Strengths: Achieved significant functional advancements in the past year, offers a wide range of pre-integrated third-party applications across various categories, and features a composable, cloud-native architecture.

Weaknesses: Has limited geographical and industry presence, some features may require third-party integrations, and certain applications are not fully integrated into the main admin console.

9. Kibo

Kibo is a multitenant SaaS platform hosted on AWS or Google Cloud Platform, offering B2B/B2C commerce, order management, and subscription commerce, available individually or as a package.

Serves customers of all sizes, mainly in retail, with additional clients in manufacturing, distribution, and healthcare.

Well-suited for retailers due to its commerce, OMS, and subscription modules, which unify online and in-store services.

Strengths: Supports B2C and B2B business models, provides an end-to-end platform with no-cost add-ons, and offers implementation support.

Weaknesses: Limited global reach, with most clients in retail, manufacturing, and wholesale distribution; integrated personalization is only available in its complete eCommerce package.

Visionarios

10. HCL Software

HCL Commerce Cloud is a hybrid SaaS platform offering both single-tenant and multitenant options, available on AWS, Microsoft Azure, and Google Cloud Platform marketplaces, with single-tenant components managed by either HCLSoftware or its clients.

Primarily serves large enterprises across various industries, including retail, manufacturing, and telecommunications.

Suitable for global organizations with complex requirements.

Strengths: Offers extensive native functionality and several modular applications, supports significant scalability, and provides a wide range of digital commerce accelerators tailored to various industries.

Weaknesses: Limited preconfigured integrations, low market presence, and its admin consoles can be complex and unintuitive for business users.

11. Oro

OroCommerce is a single-tenant SaaS platform globally deployable on OroCloud (PaaS), public clouds, private clouds, or on-premises.

Serves distribution, manufacturing, and wholesale sectors, with some presence in automotive and high-tech industries.

Ideal for B2B organizations seeking diverse use cases, such as direct-to-consumer (D2C), B2B2X, and marketplace operations, thanks to its broad business model support and native CRM capabilities.

Strengths: Provides robust B2B capabilities supporting complex catalogs and workflows for large-scale, multi-store, and multi-geographic implementations, with all features included in its pricing model.

Weaknesses: Limited integrations with third-party applications beyond ERP and payment processing, lacks strong brand awareness, and its core architecture remains monolithic.

Jugadores de Nicho

12. Infosys Equinox

A modern architecture with over 25 independently deployable SaaS multitenant modules available on any public cloud, including AWS and Microsoft Azure marketplaces. Also offered as single-tenant, managed, or on-premises solutions.

Industries served: Retail, manufacturing, media, and telecommunications.

Best for: Global retailers needing a sophisticated and flexible composable solution.

Strengths: End-to-end digital commerce solution included in one price, core commerce functionality, and a modern composable architecture.

Weaknesses: Limited options for working with alternative system integrators, restricted operational presence, and may require third-party content management capabilities.

13. Optimizely

Offers Configured Commerce, deployed as single-tenant SaaS on Microsoft Azure, independently or alongside Optimizely One DXP, PIM, DAM, CMP, CMS, personalization, experimentation, and/or CDP.

Industries served: Manufacturing, wholesale, and distribution.

Best for: Organizations seeking a comprehensive suite of DXPs and commerce capabilities from a single provider.

Strengths: Focuses on marketing functions, provides a pre-packaged solution mainly for B2B clients, and has a CMS-centric commerce package.

Weaknesses: Modular commerce solution integrated within Optimizely One, slow market expansion, and limited geographic presence.

14. SCAYLE

A modular SaaS multitenant platform, also available as single-tenant SaaS on AWS, including marketplace operations, OMS, DAM, PIM, search, checkout, promotions, headless frontend, and mobile app suite.

Industries served: Retail, consumer brands, and wholesalers.

Best for: Retailers, consumer brands, and complex wholesalers needing robust OOTB accelerators for end-to-end support.

Strengths: Comprehensive modular offerings, pay-as-you-use model, and experiential retail features.

Weaknesses: Vertical focus limits industry flexibility, lacks advanced B2B features, and offers minimal native customization.

15. Elastic Path

Offers two platforms: Self-Managed Commerce (self-hosted) and Composable Commerce (SaaS multitenant on AWS).

Industries served: High tech, manufacturing, and retail.

Best for: Organizations requiring modular and composable solutions for storefronts, product catalog management, and basic commerce functions.

Strengths: Modular functionalities, advanced product management tools, and developer-friendly.

Weaknesses: Requires external partners for sophisticated capabilities, limited market awareness, and lacks essential B2B features.

16. Liferay

Liferay Commerce is a native module of Liferay DXP, available as multitenant SaaS, PaaS, or on-premises. Cloud options are globally available on Google Cloud Platform.

Industries served: Small-to-medium B2B organizations in manufacturing and services.

Best for: Organizations building customer portals with digital commerce through its DXP and low-code application platform.

Strengths: Trusted by global clients, supports global multistore operations with flexible inheritance, and offers native DXP capabilities.

Weaknesses: Lacks an established ecosystem of third-party software vendors, limited CX features, and largely monolithic architecture.

17. Shopware

Shopware 6.5 Commerce Cloud offers commercial licenses for local and cloud implementations, available as SaaS or managed. An open-source version without B2B suite is also available.

Industries served: Wholesale/distribution, retail, and manufacturing.

Best for: Mid-sized B2C and B2B businesses seeking flexible deployment models and user-friendly platforms.

Strengths: Intuitive visual page-building interface, versatile deployment options, and features like native digital showroom capabilities.

Weaknesses: Limited geographic presence, infrequent major updates, and reliance on third-party integrations or API customizations.

18. Virto Commerce

A .NET-based platform globally available, deployed as single-tenant PaaS on Virto Cloud (defaulted to Microsoft Azure). Also supports public/private cloud and on-premises deployments.

Industries served: B2B manufacturing, distribution, and wholesale.

Best for: Organizations with .NET expertise seeking customizable solutions via open architecture.

Strengths: Global availability, flexible pricing, and modular architecture with high extensibility.

Weaknesses: Focused on specific industries with limited presence elsewhere, few OOTB functionalities, and a small ecosystem of partners and integrations.

Evaluation Publication

The full results of this study were published on November 6th of this year on Gartner’s website, with the purpose of helping application leaders make informed decisions.

You can find the study on their website: https://www.gartner.com/doc/reprints?id=1-2JBSR7YD&ct=241111&st=sb

Conclusion

According to Gartner’s analysis, the digital commerce market reached $9.98 billion in software revenue in 2023, representing a year-over-year growth of 11.2%. Companies are beginning to carefully assess additional platform expenditures or their entry into digital commerce.

This report provides a comprehensive view of the market, evaluating the capabilities of leading vendors, their execution ability, and strategic alignment with the evolving needs of businesses.

By understanding each vendor's positioning in terms of innovation, functionality, and support, application and technology leaders can identify the solution that best fits their organization’s specific business objectives, minimizing risks and maximizing return on investment.