This research helps to understand the search market in eCommerce and supports initiatives related to product discovery. It was conducted using Gartner's Magic Quadrant, a market analysis tool developed by Gartner that provides a graphical representation of the competitive positioning of vendors in a specific market.

Gartner, an information technology consultant, evaluated vendors based on the quality and effectiveness of processes, systems, methods, or procedures that enable IT vendors to be competitive, efficient, and effective, positively impacting revenue, retention, and reputation within the market.

What is a Search and Discovery Platform?

A search and discovery platform is a digital tool that allows users to efficiently find and explore content, products, or information. These platforms often utilize advanced technologies such as search algorithms, artificial intelligence, and machine learning to analyze large volumes of data and present relevant and personalized results.

Gartner defines these platforms as applications that enhance digital commerce solutions to facilitate navigation, filtering, comparisons, and product selection.

Their main features include:

Advanced Search: They offer filters and specific criteria so users can refine their searches and find exactly what they need.

Personalized Recommendations: Based on search history, preferences, and user behavior, these platforms suggest additional content that might be of interest.

Intuitive Exploration: They allow users to discover new products or information they didn’t know they were looking for through categories, trends, or related suggestions.

User-Friendly Interface: They are typically designed to be easy to use, with intuitive interfaces that make search and discovery smooth and enjoyable experiences.

Gartner Evaluation Summary

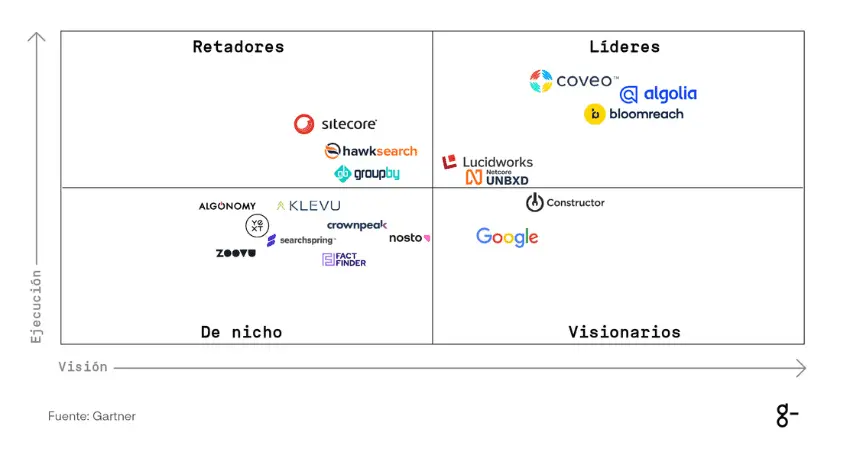

Gartner's Magic Quadrant evaluates search and discovery platforms to help businesses select the best tool for their needs. This quadrant is divided into four categories: Leaders, Challengers, Visionaries, and Niche Players.

Gartner tracked over 20 vendors, but only 18 met the inclusion criteria. However, even though some vendors were excluded, their products remain viable. Such is the case with Elastic Search, one of the most dominant search engine platforms currently available, which was not included because it did not offer a SaaS product.

Methodology

This study is based on primary and secondary research conducted by Gartner, supported but not limited to:

Gartner Peer Insights reviews for "S&PD" published since October 2023.

A survey conducted with reference customers provided by vendors during the research process.

Other sources include:

Forecast: Enterprise Application Software, Worldwide, 2021-2027, 2Q23 Update.

Recorded presentations and demonstrations where vendors provided Gartner with information about their product capabilities.

Feedback on vendors and their products gathered during thousands of conversations and other interactions with users of Gartner's advisory service in 2022 and the first eight months of 2023.

Generally available information sources.

Evaluation Criteria for Search and Discovery Platforms

The research identifies and analyzes the most relevant vendors within the market, along with their products. To be included, each vendor had to meet the following criteria as of October 31, 2023:

Actively offer at least one SaaS-based digital commerce search and discovery product that meets the market definition and established functionality.

Have their product in use by more than 50 production customers and have onboarded more than five customers in 2022.

Be used by paying customers in more than one geographic region.

Have software ARR (Annual Recurring Revenue) exceeding $9 million from the product.

The declared software ARR and customer numbers for this research had to be primarily related to the use of search and discovery in digital commerce.

In addition to indispensable capabilities for this market, which include:

Product search

Merchandising

Catalog navigation (exploration), including facets and filters, replacing a static taxonomy up to (but not including) product detail pages (PDPs).

The study uncovered the following strengths and weaknesses of the vendors:

Leaders

Coveo

Its Coveo platform is a multitenant SaaS solution that includes semantic search, AI-driven recommendations, generative answers with Coveo relevance, and unified personalization. Additionally, it features a developer hub and fosters innovation through Coveo Labs.

Based in Quebec, Canada, it has a strong presence in North America, with some presence in EMEA and Asia/Pacific. It serves various B2C and B2B industries, focusing on large enterprises and medium-sized regional organizations.

Strengths: Focus on large enterprises, strong AI vision, personalized search, customizable query pipeline, and extensive configurability for both B2C and B2B.

Weaknesses: Limited regional focus, configuration complexity, and partial product integration.

Algolia

Its multitenant SaaS solution operates on Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) for AI modeling and analytics. Algolia is an API-first product that includes search, navigation, and AI-driven recommendations, Merchandising Studio, and Analytics.

Headquartered in Palo Alto, California, it has a strong presence in Europe and North America, with a growing presence in Asia/Pacific and Latin America. It serves various industries, focusing on medium and large enterprises.

Strengths: Global reach and recognition, capabilities beyond commerce, and high speed and scalability.

Weaknesses: Product cost becomes less competitive as search volume increases, limited natural language processing capabilities, and its semantic search integration is recent and not yet thoroughly tested.

Bloomreach

Its multitenant SaaS product, Bloomreach Discovery, primarily runs on AWS but also on Google Cloud Platform. It includes search and merchandising, Loomi (an AI platform), recommendations, real-time segments, and SEO. It also offers content search and professional services.

Based in Mountain View, California, it is primarily present in North America, with a solid foothold in EMEA but little presence in other regions. It primarily serves medium and large B2C organizations in the retail industry but also has clients in the B2B manufacturing and distribution sectors.

Strengths: Significant presence in the retail sector, sophisticated merchandising, and strong customization capabilities.

Weaknesses: Limited market focus, steep learning curve, and limited scaling.

Lucidworks

Its multitenant and single-tenant SaaS solution, Fusion, primarily runs on GCP. All modules are included in the main license, with separately packaged solutions for knowledge and workspace, and for service and support.

Headquartered in San Francisco, California, it has a strong presence in North America with small bases in Europe and Asia/Pacific. It serves various industries in the retail, manufacturing, and high-tech sectors. It primarily targets large global organizations but also has some mid-sized enterprise clients.

Strengths: Focus on multiple industries, enterprise-ready, and investments in modernization.

Weaknesses: Few preconfigured integrations, limited global presence, and limited innovation.

Netcore Unbxd

Its multitenant SaaS solution operates on multiple public clouds. The modules include search and navigation (with merchandising, analytics, and optimization, and conversational AI) and recommendations.

Headquartered in San Mateo, California, it has a strong presence in North America with small bases in Europe and Asia/Pacific (excluding China and Japan). Most of its clients are in the retail sector, but it also serves the wholesale, automotive, and publishing sectors.

Strengths: Deep focus on B2C, broad AI strategy, and MACH architecture.

Weaknesses: B2C-centered vision, complex business operations, and low brand recognition.

Challengers

Sitecore

It offers two multitenant SaaS products on AWS: Sitecore Search (the content search product) and Sitecore Discover (optimized for digital commerce, with additional capabilities for merchandising, personalization, and recommendations).

Headquartered in San Francisco, California, its search business is predominantly present in the U.S., with a small presence in Europe and Asia/Pacific. It sells to both B2C and B2B organizations, primarily targeting medium and large organizations.

Strengths: Comprehensive search analytics, support for a broader DXP strategy, and strong presence in the industry.

Weaknesses: Search as a secondary offering, complex pricing, and a clunky administration interface.

HawkSearch

Its single-tenant SaaS solution includes Smart Search, an AI-driven feature designed to enhance the search experience on eCommerce sites, merchandising, and various industry accelerators.

Based in Rosemont, Illinois, it has a strong presence in North America, a solid base in EMEA, and smaller bases in Latin America and Asia/Pacific (excluding China). It serves various industries, most of which are in B2B manufacturing and wholesale. It targets customers of all sizes, primarily medium-sized ones.

Strengths: Simple pricing, differentiation for B2B use cases, and a comprehensive rules engine.

Weaknesses: Lagging in some technologies, manual administration, and a regional and mid-market focus.

GroupBy

It offers both single-tenant and multitenant options, running on Google Cloud Platform. It includes search and navigation AI, recommendation AI, enrichment, merchandising, analytics, and reporting. These are powered by Google's Vertex AI Search for Retail.

Headquartered in Toronto, Canada, it has a strong presence in North America, with smaller bases in Europe, Asia/Pacific, and Latin America. It serves multiple industries, primarily retail, wholesale, distribution, and marketplaces. Its primary focus is on regional and multicountry enterprise organizations.

Strengths: Industry and B2B use case coverage, utilizes Google Shopping data, and has strong technological expertise.

Weaknesses: Dependence on Google's roadmap, limited focus on merchandising, and lack of partners.

Visionaries

Constructor

Its multitenant SaaS platform primarily runs on AWS but can use other public clouds. The modules include search and autosuggest, navigation, recommendations, attribute enrichment, product finder quizzes, and an AI-powered shopping assistant.

Headquartered in San Francisco, California, it has a strong presence in North America, is growing in Europe, and has small bases in Asia/Pacific (excluding China/Japan) and Latin America. It primarily serves retail and targets large global organizations, though it also has clients in manufacturing, wholesale, and distribution, including medium-sized companies.

Strengths: Technological innovation, strong customer growth, and an extensive ISV connector ecosystem.

Weaknesses: Lack of focus on the mid-market, limited industry focus, and limited global coverage.

Its Vertex AI Search for Retail, a suite of multitenant SaaS APIs, runs on Google Cloud as part of its broader AI portfolio. It is divided into search, navigation, and recommendations, which share a single API. Visual search resides on a separate API.

Google is headquartered in Mountain View, California, and has a global presence. It exclusively sells its search solution for retail, both directly to customers and as a search engine that powers other vendors' products. Currently, it is oriented towards large retail enterprises.

Strengths: Global expertise in retail search, use of Google Shopping data, and semantic search.

Weaknesses: Focus on enterprise retail, technical implementation, and lack of visual merchandising.

Niche Players

Klevu

Its multitenant SaaS solution includes modules for search, category merchandising, and recommendations, with an additional enhanced analytics module.

Headquartered in Helsinki, Finland, it has a presence in EMEA and North America, with a small base in Asia/Pacific. It serves a variety of industries, primarily B2C. Its focus is on enterprise clients, although its current customer base is mostly mid-sized.

Strengths: Strong market understanding, good for multinational companies, and easy optimization.

Weaknesses: Mid-sized customer base, limited vertical coverage, and personalization.

Algonomy

Its multitenant SaaS solution operates on Algonomy's private cloud and AWS. The modules include search, discovery, catalog enrichment, and recommendations.

The company is headquartered in San Francisco, California, and Bangalore, India, with a global presence (excluding China). It serves a variety of industries, primarily focusing on medium and large retail organizations.

Strengths: End-to-end personalization, broad customer scale, and ease of use.

Weaknesses: Initial semantic search, limited B2B capabilities, and limited AI deployment.

Yext

Yext Search is a multitenant SaaS solution with a multi-cloud deployment, part of a broader platform that includes CMS, content generation, conversational AI, and SEO, along with additional GenAI capabilities.

Headquartered in New York City, it has a strong presence in North America and Europe, with a small base in Asia/Pacific. It serves a variety of industries, primarily financial services, healthcare, and retail. It focuses on large global organizations, with some SMB and mid-sized clients.

Strengths: Suitable for complex requirements, broad revenue segments, and included CMS.

Weaknesses: Few system integration partners, limited geographic presence, and limited capability focus.

Searchspring

Its multitenant SaaS solution operates on AWS. The main modules include site search, merchandising, personalization, and reporting and analytics, with optional support for B2B, navigation, recommendations, and optimization.

Headquartered in San Antonio, Texas, Searchspring has a strong presence in North America and Asia/Pacific (primarily Australia). It primarily serves the SMB and mid-market segments, especially in retail, though it also has a presence in automotive, healthcare, and high-tech sectors.

Strengths: Focus on the mid-market/SMB, simple pricing model, and system integration partners.

Weaknesses: Limited global presence, few ISV partners, and limited industry focus.

Crownpeak

Its multitenant SaaS solution, Fredhopper, operates on AWS. It includes Experience Orchestrator for recommendations and personalization.

Headquartered in Denver, Colorado, Crownpeak has a strong presence in EMEA, with small bases in North America and Australia. It serves a variety of industries, primarily retail, and targets mid-sized and global B2C organizations.

Strengths: Multisite and global operations, visual merchandising, and comprehensive personalization.

Weaknesses: Fragmented product portfolio, limited global presence, and basic B2B support.

Nosto

Its multitenant SaaS solution, Product Experience Cloud, runs on AWS as part of the Nosto Commerce Experience Platform (CXP). The modules include personalized search, category merchandising, product recommendations, and dynamic bundles.

Headquartered in Helsinki, Finland, it has a strong presence in Europe and North America, with a growing base in Asia/Pacific. It serves various industries, primarily brands and/or retail. It targets mid-sized B2C organizations.

Strengths: Personalized discovery, integrated segmentation, and multiregional and multinational support.

Weaknesses: Strong focus on a single partner, potential technology coverage, and limited enterprise clients.

Zoovu

Its multitenant SaaS solution includes modules like Search Studio and Conversation Studio, and is built on theZoovu Data Platform.

Headquartered in Boston, Massachusetts, Zoovu has offices in Europe and a presence in Latin America. It targets enterprise brands, retailers, and B2B distributors and is best suited for the complex needs of large enterprises.

Strengths: Innovation-driven, clear and scalable pricing, and intelligent guided selling.

Weaknesses: Limited regional coverage, low awareness and presence, and limited configurability of core search.

FactFinder

It offers a hybrid single-tenant multitenant SaaS platform with modules including product discovery, navigation, merchandising, personalization, and recommendations, with add-ons like Geo (geolocation-based search), customer-specific insights, and predictive cart.

Headquartered in Pforzheim, Germany, it has a strong presence in Europe and small bases in North America and Asia/Pacific. It serves various industries, primarily B2B construction, home goods, fashion, and sporting goods. It focuses on mid-sized to large enterprises.

Strengths: Suitable for multinational businesses, strong market understanding, and intuitive product search.

Weaknesses: Limited semantic search capabilities, low visibility outside its main region, and basic reporting and analytics.

Report Publication

This new Gartner research report provides an in-depth analysis of the technologies, trends, and solution providers in search and discovery.

You can download the full report at the following link: https://www.gartner.com/en/documents/5425963

Conclusion

According to Gartner's analysis in May 2024, a new conversational interface pattern based on Generative Artificial Intelligence (GenAI) is expected to transform product searches, reaching at least 5% of the market by 2026.

This type of interface uses artificial intelligence to generate responses and dialogues dynamically and naturally, allowing users to interact with search and discovery systems through conversations similar to those they would have with an AI like ChatGPT.

Generative AI understands the context, interprets user needs, and offers personalized responses or suggestions in real-time, improving the user experience by making it more intuitive and accurate. For example, instead of typing a series of keywords into a search engine, a user might simply say, "I'm looking for a gift for my best friend's wedding," and the generative AI would respond with specific product suggestions, offering a more personalized and efficient experience.

This innovative approach is revolutionizing traditional search and navigation interfaces, and it is expected to have a significant impact on how we search for and discover products in the coming years. Companies are looking for these platforms to offer and support a unique, engaging, and consistent customer experience across multiple channels. Everyone wants more flexible and agile implementations, as well as post-implementation extensions that accelerate time to market, reduce total cost of ownership, and generate desirable digital business outcomes.

Innovations in product search and discovery can be adopted without completely rebuilding digital commerce platforms; however, it is important to make a good choice and consider the needs of each business.