Vesta: Fraud prevention and fraud protection

Vesta is a leading anti-fraud protection solution in the industry that uses advanced algorithms and real-time data analysis to ensure the security of your transactions

What is Vesta?

Vesta is a global platform that guarantees transactions for online purchases, helps achieve higher approval rates, increased revenue, and reduced costs, while also offering a better user experience and eliminating fraud for leading brands in telecommunications, eCommerce, and others.

The company is based in Portland, Oregon, and has offices in Atlanta, Miami, Ireland, Mexico, and Singapore. It was founded in 1995, a decade before the advent of smartphones and the beginning of modern e-commerce. Its initial mission was to provide fraud protection and real-time decision-making for telecommunications companies and prepaid mobile card providers.

Today, Vesta remains steadfast in its commitment to protecting its clients and has expanded solutions to high-risk industries such as e-commerce retailers, fintech, financial services, digital travel, online gaming, electronic tickets, and more.

Vesta offers innovative solutions against fraud. It is a true native cloud-based global infrastructure that provides trust and peace of mind.

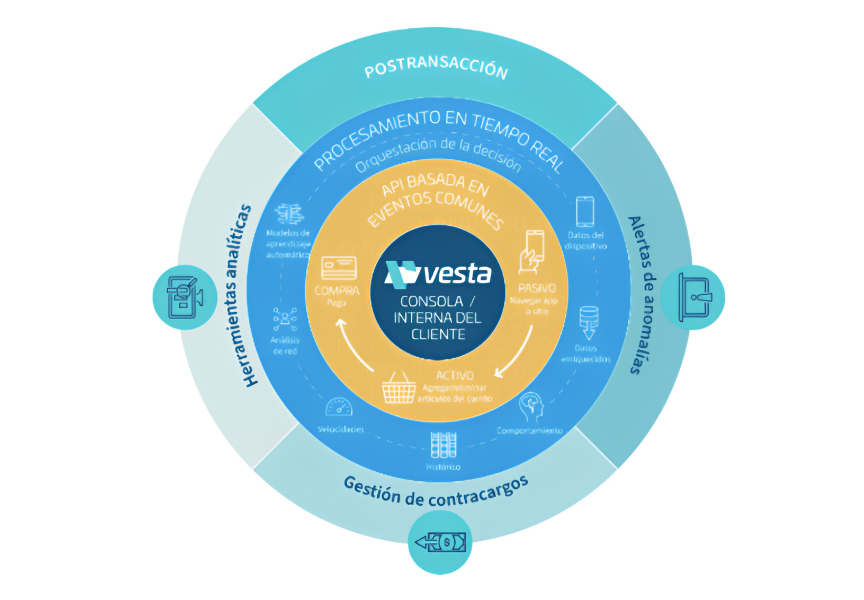

The first step this platform takes is to analyze connections between transactions to detect fraud patterns. It uses graph network analysis to easily identify connections between scammers and instantly visualize shared data points, such as emails, phone numbers, etc. among individuals or entities.

Its console is user-friendly and customer-centric, allowing you to move at your own pace with self-service onboarding, adapting to your customization needs. Additionally, it introduces positive and/or negative lists for greater convenience than traditional decisions based solely on rules

What solutions does it offer?

Every e-commerce business faces the constant challenge of fraud, as cybercriminals continually update their attack methods. It's very challenging for online businesses to have an effective protection method.

For this reason, the Vesta platform includes the Payment Guarantee and Payment Protect solutions, which leverage Vesta's years of fraud management experience, creating new machine learning models to do an excellent job distinguishing legitimate from fraudulent transactions.

Payment Guarantee

With Vesta's Payment Guarantee, switch to zero fraud liability by eliminating chargebacksand reducing costs. All approved transactions are 100% guaranteed.

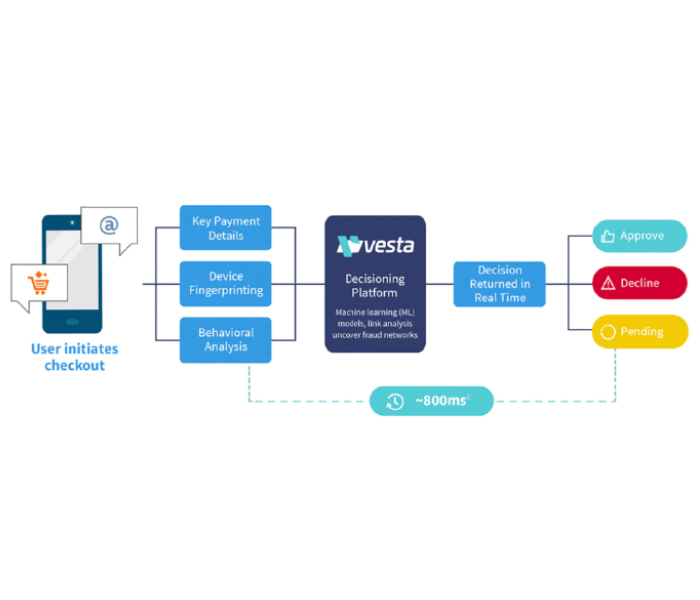

It's a cutting-edge solution that uses artificial intelligence (AI) for automated learning to detect, assess, and block digital fraud in real-time within milliseconds.

This product increases approvals for legitimate sales, bringing fraud costs to zero and offers a guarantee that covers the transaction cost if identified as fraudulent, absorbing 100% of the responsibility with its "Zero Fraud Guarantee" policy.

It includes chargeback processing so businesses can focus on boosting their sales; approved transactions generate more revenue and enhance the customer experience.

How it works:

From the moment a customer selects "Place Order" to the final decision, the Payment Guarantee solution is fast, frictionless, and accurate.

Payment Protect

With Payment Protect, make automated decisions for swift approvals, while also safeguarding and boosting revenue with an enhanced perception of risk score.

Its risk scoring solution provides a set of decision-making tools that allow fraud management teams to make real-time decisions, facilitating the acceptance of secure transactions and the rejection of fraudulent ones.

Additionally, its console is user-friendly and offers dashboard views that help you identify risky transactions and make informed decisions.

Benefits of Payment Protect:

Protect every transaction: Efficiently detect fraud with pre-configured rules that are ready to use from day one.

Reduce operational cost: Eliminate the hassle of having multiple solutions by managing fraud operations from one control panel.

Drive business growth: Save costs by reducing manual reviews, allowing you to focus on generating revenue.

Features of Payment Protect:

Data-backed decision making: Protect your revenue from scammers by leveraging precise risk scores designed by data scientists.

Risk level assessment: View a detailed perspective on the risk level of transactions to instantly determine if an order is very secure, very risky, or something in between.

Detailed risk score reasons: Optimize decisions with explanations of the risk score that provide the reasons behind a score, allowing you to make more informed decisions.

User-friendly analytical tools: Use straightforward analytical tools that help you find the best risk score threshold for your orders. Plus, delve into specific segments to make more refined decisions and achieve more approvals.

Benefits of Using Vesta

The Vesta platform not only helps in achieving higher approval rates, increased revenues, and lower costs but also offers the following advantages:

Advanced Fraud Detection: Utilizes top-tier data to analyze behaviors and transactions, allowing for advanced fraud detection.

Cutting-Edge Technology: Modern machine learning techniques provide innovative link analysis using a global data consortium.

Accept All Payment Types: With Vesta, payment methods like ACH, debit, credit, gift cards, and alternatives like PayPal, digital wallets, cryptocurrencies, and others are safeguarded and secure.

Multilevel Analysis: It employs a multilevel approach using artificial intelligence and machine learning, continuously updating to identify fraud patterns and anomalies.

Guaranteed Transactions: Guarantees all approved digital transactions, eliminating the risk and liability for fraud.

Absolute Coordination: The fully coordinated solution seamlessly integrates with the provider for comprehensive fraud detection.

Companies Using Vesta

Leading companies worldwide trust Vesta to protect against fraud. The platform is utilized by e-commerce retailers, telecommunications companies, financial services, and the travel and hospitality industry.

With Vesta, companies of any size can operate without fear of fraud.

Benefits for Vesta Customers

Being a Vesta customer ensures your account is protected, as the account protect function is integrated into the fraud protection platform, from activation to continuous monitoring of activities with the latest artificial intelligence techniques.

This solution shields you from threats of fraud during the registration of new accounts and attacks from unauthorized accounts. Its key features include:

Pre-validation Service Using Native Biometric Verification: Verifies the identity of new users, with an information flow verifier integrated during user registration. Upon initiating verification from their mobile, they receive a link via text. The new user needs to scan the required documentation, take a selfie with vitality detection, and post identity verification, they are prompted to register their facial ID or fingerprint enabling biometric account authentication.

Monitors User Activities: As soon as someone accesses your online store's login screen, Vesta evaluates the entire device, IP address, phone model, and behaviors like keystrokes; if anomalies in the device and typing are detected, access is halted thanks to biometric authentication.

Detects and Halts Unauthorized Access: If someone tries to log in using another user's information, the device from which the attempt was made is blacklisted, ensuring it cannot access any account of your online business.

10 reasons to choose Vesta

As we've seen, Vesta is a leading anti-fraud protection solution in the industry that uses advanced algorithms and real-time data analysis to ensure the security of your transactions. But why should you use Vesta? Here are 10 reasons to start using the platform:

Adaptable to any business: Vesta is ideal for businesses of any size, whether you have 10 or 1000 transactions a month.

Flexible pricing: The prices are flexible and can adapt to the size of your business.

Seamless integration: The application is easy to set up and integrate, and comes with a trial period.

Guarantee: Decisions are 100% guaranteed in real-time; no liability for your business.

Satisfied customers: You'll gain more reliable and satisfied customers.

Maximum protection: Protect your customers' information and resources.

Impeccable reputation: Maintain your brand's flawless reputation.

Successful transactions: Your company will achieve more approved transactions.

End fraud: Eliminate losses from fraud and increase approvals.

Intuitive management: It has an easy-to-use and manage console.

At Gluo, we strengthen the security of your transactions with Vesta's protection.