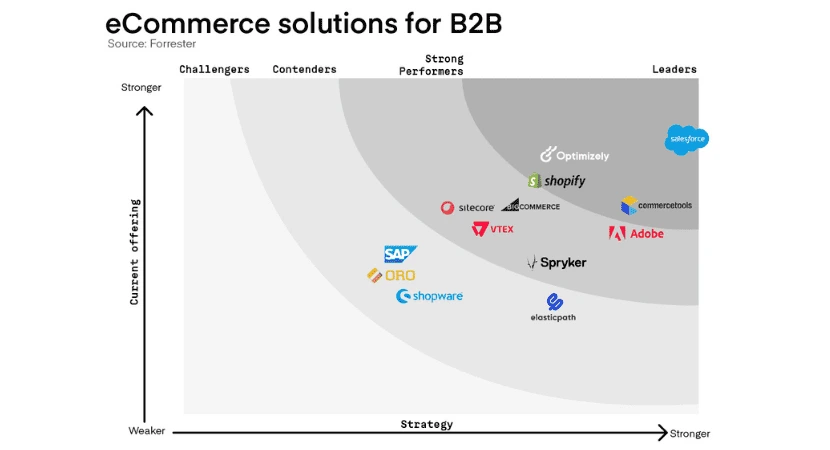

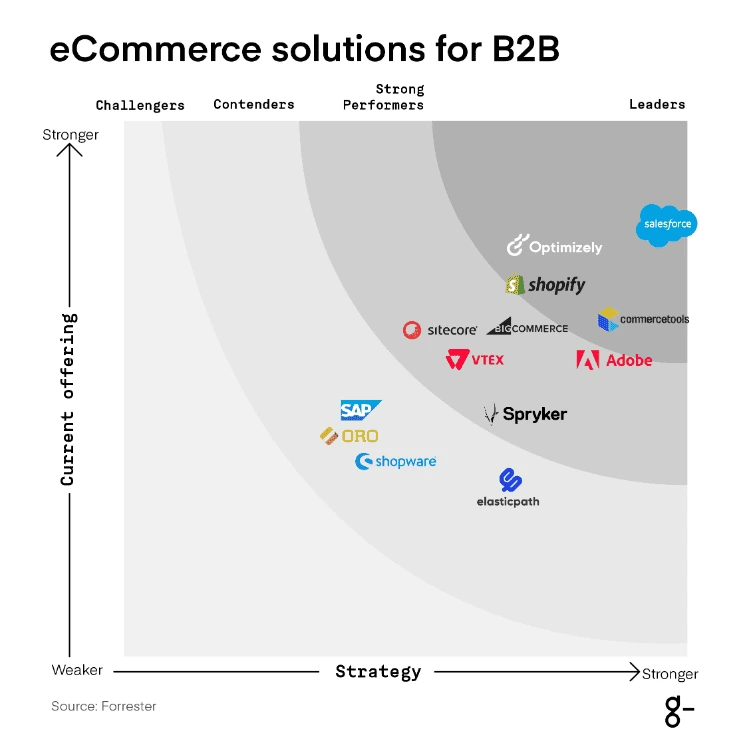

The Forrester Wave is a market research and analysis conducted by Forrester Research that evaluates and compares technology and service providers in a specific segment. This evaluation is based on defined criteria, including product offerings, strategy, market presence, and other relevant factors.

In Q2 2024, Forrester conducted an evaluation that included 24 criteria for B2B commerce solutions, identifying the most significant providers, which were then researched, analyzed, and rated. This report reveals the capabilities of the evaluated vendors and helps technology companies choose the right provider for their needs.

What Are B2B Commerce Solutions?

B2B commerce solutions are platforms and tools designed to facilitate commercial transactions between businesses. These solutions can include:

Online Sales: Applications that allow businesses to upload their product catalog to a website to receive purchase orders from their clients.

Inventory Management: Tools for controlling and optimizing inventory, ensuring that clients have access to the products they need.

Order Automation: Systems that enable businesses to automate order creation and management, reducing time and effort.

Customer Relationship Management (CRM): Software that helps companies manage their interactions with clients and prospects, improving communication and customer satisfaction.

Payment Platforms: Solutions that facilitate payment processing between businesses, often with financing and credit options.

Integrations and APIs: Tools that allow for the connection of different systems and applications to improve efficiency and information flow between businesses.

Data Analytics: Tools that provide insights into purchasing behavior, market trends, and operational efficiency, helping companies make informed decisions.

These solutions are designed to improve efficiency, reduce costs, and facilitate collaboration between businesses in a B2B environment.

Summary of the Forrester Evaluation

This evaluation is intended as a starting point and encourages clients to consult product assessments and adjust the weighting of criteria using the vendor comparison tool.

The vendors were divided into three categories: leaders, high-performing companies, and contenders for market leadership.

It is an evaluation of the leading providers in the market but does not represent the entire vendor landscape.

The analysis uncovered the following strengths and weaknesses of individual providers:

Leaders

Salesforce

Salesforce is known as the largest enterprise software company in the world and for reorienting the company toward providing AI for the masses.

Its strength lies in its vision, thanks to its new Embedded Commerce strategy, which helps customers start transacting with small steps, as well as its set of AI-driven features that enable clients to scale efficiently as transactions increase.

Salesforce’s strengths are in its robust customer account functionalities and contractual rights to model complex purchasing organizations. Salesforce B2B Commerce is best suited for companies in the manufacturing, automotive, and energy sectors that have already invested in other Salesforce solutions.

commercetools

commercetools is recognized as the perfect example of MACH architecture and has recently shifted its focus to helping customers achieve a best-of-breed architecture with Foundry.

commercetools' growing portfolio focuses on providing proven practices (also known as architectural opinions) around its opinionless APIs, making it the right solution for more companies. Its strength lies in its application architecture, extensibility, and integration with ISV solutions through no-code configuration.

commercetools is the best choice for digitally mature manufacturers and resellers of industrial and specialized products who need differentiated experiences.

Optimizely

Optimizely is known for building a portfolio of integrated applications as a cohesive DXP. Its commerce offering includes freemium editions of products from its portfolio, testing, and customer data platform.

Its architecture is solid, placing its single-tenant SaaS at the core, surrounded by a dozen multitenant features. Optimizely's strength lies in its testing and optimization capabilities, something less than half of the providers in this evaluation offer natively.

Optimizely Configured Commerce is the best choice for manufacturers and industrial distributors in sectors like electrical, plumbing, or construction looking for a practical, ready-to-use feature set.

Shopify

Shopify is known for its mission to improve commerce for everyone. For years, this meant enabling entrepreneurs to create an online store, then focusing on providing digital capabilities to emerging DTC (direct-to-consumer) brands.

It has a strong developer community that could potentially help conquer other B2B use cases beyond the consumer goods space where it is well known.

Its strength lies in its AI, which powers its Sidekick feature, allowing non-technical users to request promotional configurations and UI changes through natural language. Shopify Plus is ideal for consumer brand manufacturers operating a wholesale channel for small retail partners.

High-Performing Companies

Adobe

Adobe is known for helping its clients drive experience-based growth through its suite of integrated applications: Adobe Experience Cloud.

Adobe excels in personalized search, utilizing its AI, Sensei, in combination with signals captured through Adobe Experience Platform, which is at the core of Adobe's strategy to modernize its acquired products and integrate them with the rest of Experience Cloud.

Its strength lies in its partner ecosystem and a community that knows how to implement its solution in B2B scenarios. Adobe Commerce is ideal for global experience-focused brands with a wide range of use cases such as customer portals, dealer stores, and marketplaces.

BigCommerce

BigCommerce is recognized as the open SaaS platform for all stages of eCommerce growth.

It features a core MACH architecture and a curated app store that allows clients to enhance their capabilities as needed, without the burden of a costly platform migration.

Its strength is in the frontend, thanks to existing investments in its Next.JS capability and the recent acquisition of Makeswift for visual editing. BigCommerce is ideal for manufacturers and distributors of brands of all sizes seeking the control offered by a MACH architecture, and for those who don’t want to restructure their platform as their business grows.

Intershop

Intershop is known for its long-standing history in B2B commerce and years of intense modernization in close collaboration with Microsoft Azure to decouple its architecture without disrupting its customers or go-to-market strategy.

It strikes a balance between being feature-rich, flexible, and scalable enough to power businesses like the distributor network SHOPcloud360.

Its strength lies in personalized search, thanks to its investment in Sparque.ai. Its application architecture is solid, with many capabilities decoupled from the core into microservices. Intershop is ideal for manufacturers of industrial equipment offering portals for monitoring, service, and spare parts ordering.

Sitecore

Sitecore is known for modernizing its DXP through a series of acquisitions, including OrderCloud and Discover, which together form its Commerce Cloud.

It uses Microsoft Fabric to harmonize data into insights to be utilized through new copilots for customers.

Its strength lies in its cloud-native application architecture, offering fine-grained APIs that do not restrict clients to building variations on a template. Sitecore is ideal for companies with complex business models and mature development capabilities needing a highly flexible commerce solution to power differentiated shopping experiences.

VTEX

VTEX is known as the backbone of connected commerce, offering a unified platform for commerce, order management, and marketplaces.

Its approach focuses on what it calls "Pragmatic Composability," where customers can start with VTEX as an all-in-one solution and then swap out native capabilities for best-in-class third-party solutions as the ROI becomes clearer.

Its strength lies in extensibility and integration, powered by its serverless VTEX IO infrastructure and data-as-a-service layer. VTEX is ideal for manufacturers with B2B and DTC initiatives who want a complete commerce stack with the option to customize and compose with higher-quality components.

Spryker

Spryker is known for handling a wide variety of business models and complex use cases. It achieves this with its Application Composition Platform, which clients use to assemble the parts they need, whether developed in-house or by an ISV partner.

Its product strategy focuses on flexibility and helping customers be future-proof so they can seize any growth opportunities that arise. Its strength lies in its excellent extensibility and integration, driven by its integrated iPaaS capability, white-labeled from Alumio.

Spryker is ideal for manufacturing companies with complex business models in dynamic and transforming industries, such as electrification and mobility.

Contenders

Elastic Path

Elastic Path is known for being a pioneer in headless commerce and an early adopter of the composable commerce approach.

Its portfolio focuses on core features such as cart, checkout, and customer account hierarchies, with modules for product experience, a visual frontend editor, and an integration hub.

Elastic Path offers strong extensibility and integration, as demonstrated by its no-code integration hub, Composer, which acts as a backend palette combining services from multiple providers to power modern frontends. Elastic Path is ideal for manufacturers with an authorized distribution network that sells complex products.

Elastic Path declined to participate in the full evaluation process of the Forrester Wave.

SAP

SAP is known for powering some of the most complex and large-scale B2B sites.

It frequently delivers smaller updates and offers new capabilities such as multitenant services. SAP's strategy aims to revitalize its offering, avoiding leaving customers stranded on older versions or launching a "me too" product in an already saturated market.

Its strength lies in assisted purchasing and quoting. SAP Commerce Cloud is ideal for complex enterprises with a significant existing investment in SAP ERP and a large hybris installation they want to preserve.

SAP declined to participate in the full evaluation process of the Forrester Wave.

OroCommerce

OroCommerce is known for being founded by the co-founders of Magento, with a specific focus on B2B.

Its product is an integrated B2B commerce, CRM, and marketplace package offered as open source, on-premise license, or single-tenant SaaS in Oro Cloud. It provides a robust set of ready-to-use features on a low-code and professional-code framework for building customizations.

Its strength lies in assisted purchasing and quoting, thanks to its orientation around its integrated CRM module, which gives sales teams the necessary tools to work with customer opportunities. OroCommerce is ideal for mid-sized distributors with complex sales processes, including self-service and seller interactions.

Shopware

Shopware is known for its impressive $100 million Series A investment from PayPal and Carlyle in 2022.

It has a strong community, driven by its open-source roots and bolstered by new investments to encourage creative applications.

Its strength lies in its strong workflow and business process modeling, particularly in its no-code Flow Builder, which, along with Rule Builder, drives several parts of the core application. Shopware is ideal for mid-sized companies or divisions of large enterprises looking for a quick start with ready-to-use features.

Methodology

To conduct this evaluation, Forrester grouped its evaluation criteria into three high-level categories:

Current offering: A provider's position on the vertical axis of the Forrester Wave chart indicates the strength of its current offering. Key criteria for these solutions include application architecture, AI, account rights and customer contracts, and assisted purchasing and quoting.

Strategy: The horizontal axis indicates the strength of the providers' strategies. We evaluated vision, innovation, and roadmaps.

Market presence: Represented by the size of the markers on the chart, our market presence scores reflect the providers' revenues and number of customers.

The criteria providers had to meet to be included in the evaluation were:

Substantial B2B product revenue. Each provider has at least $20 million in B2B product revenue.

Strong B2B commerce support. These providers offer functions for a variety of B2B commerce use cases and have recent and ongoing adoption among large manufacturers and distributors with both direct and indirect go-to-market routes.

A broad customer base. Providers have an existing customer base of global enterprise clients and focus on more than one region, with current evidence of engagement and adoption among Forrester clients.

Evaluation publication

The full evaluation results were published online in a report that includes detailed product assessments and rankings, with the goal of allowing companies to use the scores and analyses as a benchmark to determine if the providers' offerings align with their needs.

You can find it at the following link: https://reprints2.forrester.com/#/assets/2/693/RES180810/report

Conclusion

The B2B commerce solutions market is made up of providers that have achieved a balance between modern architecture and a proven set of functionalities.

It is no longer necessary to choose between having the functionalities your customers demand or the agility your commercial teams need. This is because new cloud-native providers have invested in functionalities, and established players have modernized their architectures. Now, both groups allow you to assemble your commerce platform using the components that best fit your needs.

This study will help you make the right choice in selecting the provider that best suits your particular business model. The feature sets, partners, and success teams of these providers are designed for industry-specific use cases.